When developing Botanix, we continuously asked ourselves: can systems built on Bitcoin truly be considered sidechains or L2s? This is a complex question, because from a technical standpoint, Bitcoin—given its current capabilities—cannot serve as an L1 for L2s in the same way we see in other ecosystems. Typically, L2s rely on smart contracts deployed on the base layer to verify proofs. For instance, in Ethereum-based L2s, this verification is performed by a deterministic function within a smart contract, which all Ethereum nodes execute when processing transactions.

With Bitcoin, things are both simpler and more complicated at the same time. Discussions around L2s on Bitcoin are often confusing. Unlike Ethereum, where Turing-completeness and expressiveness are native to the protocol, Bitcoin’s current capabilities are extremely limited, and there are many nuances around what is and isn’t technically feasible. That said, what is built on top of Bitcoin does not actually have L2 or Sidechain functionality. Why do we think it makes more sense to call it Bitcoin Chains rather than Extensions or L2? The point is that chains on top of Bitcoin usually have their own logic of operation and form ecosystems based on that.

Bitcoin doesn’t support smart contracts in the same way Ethereum does. Any complex logic must be implemented through structures that operate on top of Bitcoin. As a result, Bitcoin itself cannot directly verify proofs or maintain smart contract state. Most types of proofs are too large to be stored on-chain—Bitcoin transactions allow for only 80 bytes of arbitrary data. Solutions like Starkware’s m31 are highly specialized and proprietary. Even if you manage to publish a proof or a state update on Bitcoin, the process more closely resembles Optimistic Rollups. However, waiting a full week for fraud proofs to resolve is impractical, and relying on third-party bridges introduces latency or trust assumptions—both of which are undesirable in a Bitcoin-native environment.

Interaction with Bitcoin is limited to UTXOs with ScriptPubKey and transactions that transfer BTC. The OP_RETURN opcode allows only 80 bytes of data, which is insufficient for handling complex data structures. Because of these constraints, using Bitcoin as a fully functional L1 for L2 systems is unlikely without significant protocol changes—changes that would require hard forks. Such modifications could potentially compromise both the value proposition and the uniqueness of BTC as an asset. For instance, there's still no consensus among developers and the broader community around introducing new opcodes like OP_CAT for CatVM. Even when there is consensus, activating a BIP (Bitcoin Improvement Proposal) can take years to go live.

That’s why Botanix aims to build a chain that leverages Bitcoin as it exists today, rather than attempting to force it into an L1 role or propose radical changes to the network. This is made possible through Spiderchain technology and a network of orchestrators. So, what’s actually happening right now in the ecosystem being built on top of Bitcoin?

Background: The Emerging Landscape of Bitcoin Chains (L2s)

Despite the points we've outlined above, most projects still prefer to label themselves as L2s, using the term as a kind of catch-all. One of the earliest projects to claim the title of a Bitcoin L2 was Stacks. While it does anchor data to Bitcoin and connect with BTC, Stacks is ultimately a separate blockchain with its own consensus mechanism. Other projects, like BounceBit, even go so far as to call themselves Bitcoin L2s simply because they use BTC as part of their consensus mechanism—alongside their native token. But this isn't quite accurate. In fact, BounceBit’s architecture more closely resembles a restaking model layered on top of its own blockchain, and Bitcoin’s consensus only plays an indirect role in the overall system.

Still, the idea of making Bitcoin a more “alive” asset—one that can do more than just serve as a store of value—has long captured the attention of developers. And this vision is becoming increasingly relevant in the context of the current supercycle that began in 2022. While Ethereum’s value increased around 4x from its cycle low to high, Bitcoin—despite being slower-moving and more "heavyweight"—saw a 6x increase. Interesting dynamic, isn’t it? It only reinforces Bitcoin’s position as the dominant asset in the web3 space in recent times.

Source: https://app.artemis.xyz/

Looking at value utilization metrics such as TVL—which indirectly reflects how the base asset is used within ecosystems—the contrast becomes even more striking. TVL represents the value capacity of an ecosystem, both in terms of applications built on top of it and the utilization of the base asset in L2s operating over the L1. When comparing TVL relative to FDV, Bitcoin demonstrates significant upside potential, especially when evaluated alongside networks like Solana and Ethereum.

Right now, Bitcoin's TVL in decentralized applications, is just 5.5 billion dollars, compared to an enormous 1.74 trillion dollars of FDV. That means only a tiny fraction of Bitcoin’s value is actually being utilized on-chain. Compare that to Ethereum – with 48.9 billion dollars in DeFi applications and staking infrastructure (Lido, EigenLayer, Rocket Pool, etc), a much larger share of its 228 billion dollars FDV is actively working within the ecosystem. As you can see, the difference is clear. Solana also has a relatively high TVL compared to its FDV—8.25 billion dollars versus 76 billion dollars. Just look at that gap! 8.25 billion dollars and 76 billion dollars, compared to 5.8 billion dollars and a whopping 1.73 trillion dollars!

| Ethereum | Solana | Bitcoin | |

|---|---|---|---|

| FDV | $228 billion | $76 billion | $1.74 trillion |

| TVL | $48.9 billion | $8.25 billion | $5.8 billion |

| TVL/FDV ratio | ~21.45% | ~10.86% | ~0.33% |

Source: DefiLlama, Coinmarketcap data

Quite a striking difference, isn’t it? There's a massive opportunity for further upside within the Bitcoin ecosystem—and that’s exactly what attracts protocol builders working on top of Bitcoin.

At the same time, there are other factors that can both drive innovation in technologies like Botanix and, paradoxically, slow down the broader development of the Bitcoin ecosystem. This paradox lies in the mindset of BTC holders, who traditionally prefer to keep their assets in wallets for extended periods of time. Unlike Ethereum’s DeFi users, who actively interact with protocols, BTC holders tend to prioritize security, self-custody, and strict alignment with Bitcoin’s core principles. That’s one reason why synthetic or bridged versions of BTC—those operating on non-Bitcoin-native blockchains—have seen relatively limited adoption. There’s a deep-rooted reluctance among Bitcoin users to trust ecosystems that aren't directly anchored to the Bitcoin network.

BTC has intrinsic value, predominantly functioning as a long-term store of value. This is reflected by the fact that over 60-70% of Bitcoin has not moved between wallets in more than a year—a figure that continues to increase, underscoring the growing presence of long-term inactive holders. Record high in November 2024 - 70.54%, then this value began to decline amid the rise in the value of BTC.

Source: https://studio.glassnode.com/charts/supply.ActiveMore1YPercent?a=BTC&category=&zoom=all

Additionally, Long-Term Holder Supply and Spent Output Profit Ratio (SOPR) have also shown sustained growth trends (on a global graph). This means that Bitcoin attracts more long-term holders, reinforcing BTC’s value as a long-term store of wealth. This is due to the fact that the Bitcoin blockchain is the most decentralized, robust, trustless and censorship-resistant, which securely protects BTC as a safe asset.

Source: https://charts.bitbo.io/long-term-holder-supply/

Source: https://charts.bitbo.io/long-term-holder-supply/

As we see from the other side - changes in these dynamics also suggest that potentially new Bitcoin hodlers may also view BTC as a moving asset. But do they want to mess with wrappers or do they still prefer a more direct utilization of Bitcoin? To answer this question, let's look at how the Bitcoin Chains (L2s) landscape has evolved against the backdrop of the information outlined above.

The Bitcoin Chains (L2s) Landscape Is Skyrocketing

Initially, the ecosystem on top of Bitcoin started developing much earlier than Ethereum's history of scaling through L2s. Lightning, which appeared 3 years earlier than Plasma and 5 years earlier than the first rollups, has achieved decentralized payment scalability. But it inherits many design limitations such as interactivity (requiring a user to be online to receive payments), complexity of payment routing in multi-party scenarios, and complex inbound and outbound liquidity requirements.

Some of these issues are addressed by an alternative L2 protocol called ARK, which introduces ASPs (Ark Service Providers) to facilitate the settlement of payments between users in a private manner, while still allowing trustless redemption of bitcoin on the mainchain. However, caveats such as interactivity remain without the introduction of covenants, and high capital requirements make this protocol inefficient.

These previous Bitcoin Chains have proven useful for payments, but they still have scaling limitations and don't even try to add functionality to Bitcoin. Then came the emergence of more complex and functional designs. At the same time, more complex solutions were already emerging in parallel: Rootstock was introduced in 2015, and Stacks was originally presented as early as 2013. However, both had a long road of development ahead of them.

Eventually, just two years ago, Bitcoin’s presence in decentralized applications was minimal. In early 2023, only a few hundred million dollars of BTC were deployed in DeFi—a drop in the ocean compared to Bitcoin’s massive market value. But in 2024, everything changed. Some of the earliest efforts to bring programmability to Bitcoin came from platforms like Rootstock and Stacks. By the first half of 2024, according to DefiLlama data, Rootstock held around 294 million dollars and Stacks held around $289 million dollars in BTC value which amounted to a total of $570M combined. In 2024, the picture changed significantly when the Bitcoin ecosystem's pitch got a rebalance with the arrival of new players. Whereas in February 2024 over 94% of TVL was shared between Rootstock and Stacks, at the time of March 2025 this has become much more diverse.

Sources: DefiLlama data, en.coin-turk.com

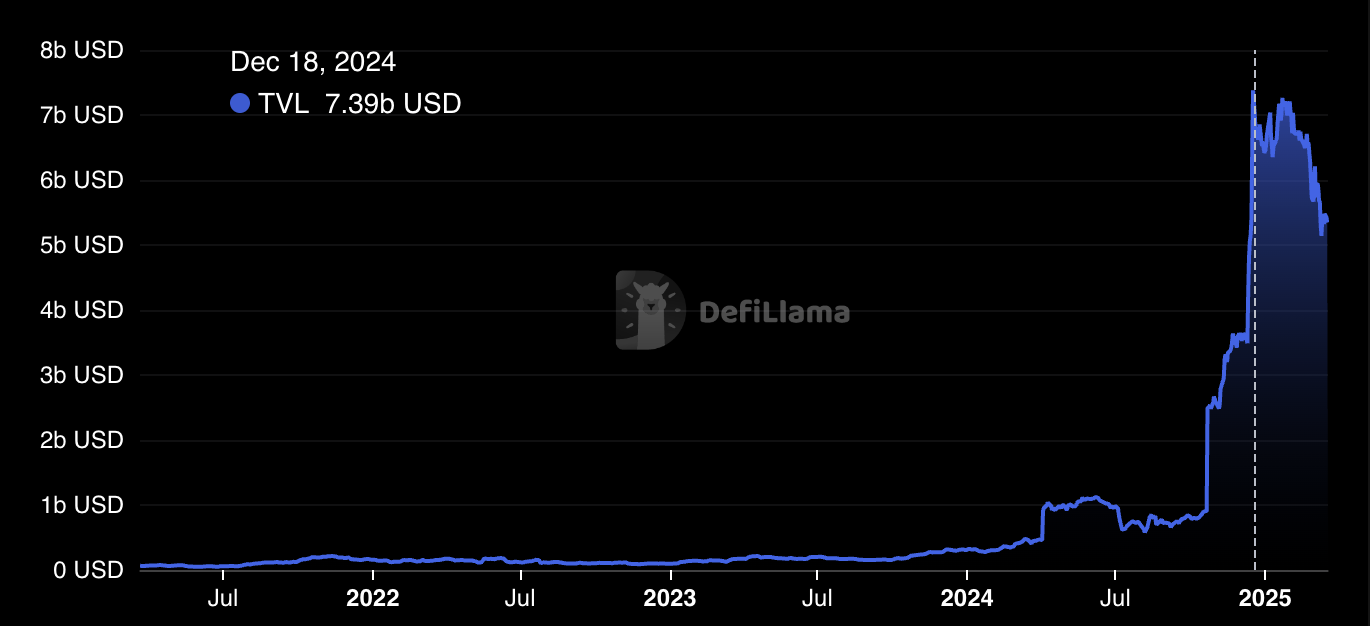

Against this backdrop,by the end of the year, Bitcoin’s TVL had skyrocketed over 20x—from just $307 million in January 2024 to $6.5 billion by December 2024. A staggering 2,000%+ increase in a single year. This wasn’t just growth—it was a breakout moment for Bitcoin in on-chain finance. This peaked in December 2024 at 7.39 billion dollars after starting to rise in October. Why did this happen?

Source: DefiLlama

In 2024 alone, the Bitcoin ecosystem surged by 600%, surpassing 30,000 BTC in total value locked. That’s nearly $3 billion now actively utilized within these scaling solutions. The message is clear—Bitcoin is evolving. It’s no longer just a store of value; it’s becoming an integral part of the on-chain economy.

At the same time, Rootstock and Stacks began to lose ground, giving way to newer and more feature-rich protocols. Bitcoin programmable layer solutions exploded, paving the way for a new era of Bitcoin DeFi. Today, according to L2Watch data, more than 75 Bitcoin-based projects are in development—ranging from EVM-compatible chains and rollups to entirely novel sidechains. And they all have one goal: to unlock Bitcoin’s vast liquidity and integrate it into a broader DeFi ecosystem.

Source: L2.Watch data

Along with the diversity of protocols, the capacity of the Bitcoin ecosystem began to grow. The space has come a long way—from basic network extensions for payments (overlay networks such as Lightning) to complex ecosystems (chains) offering a wide range of capabilities. But the core challenge isn’t just about building chains that unlock new possibilities for Bitcoin holders—it's about doing so while preserving the originality and security of BTC itself. This is a far more complex task than simply creating a bridge with mint-and-burn mechanics for synthetic wrappers. Botanix addresses this by leveraging Spiderchain technology and a network of Orchestrators, maintaining a direct connection to and continuity with the native Bitcoin network.

The evolution of these technologies facilitates a shift from HODLing to Yield: Bitcoin in DeFi and Real-world assets also known as RWA. Botanix's goal is precisely to enable this "smart utilization of BTC" without detaching it from the Bitcoin blockchain itself. Bitcoin Chain solutions equipped with smart contracts allow on-chain lending, borrowing, trading, and yield generation, mirroring Ethereum’s DeFi ecosystem. This enables BTC holders to earn yield or utilize their bitcoin as collateral without relying on centralized custodians. As VanEck highlighted, such Chains and abstraction technology will transform Bitcoin from a passive store of value into an active participant in decentralized ecosystems. It also leads to further unlocking liquidity and fostering cross-chain innovation.

Conclusion

Bitcoin is thus no longer limited to its role as digital gold held in storage. With innovations like Botanix Spiderchain and Botanix EVM, Bitcoin is becoming increasingly usable, dynamic, and actively integrated into the on-chain economy. The last two years have demonstrated what's possible—a rapid expansion from virtually zero to billions in BTC-based DeFi. Looking ahead, as technology matures and adoption grows, Bitcoin's locked value can evolve into unlocked opportunities, bridging the gap between how things were and how they will be in the new era of Bitcoin-powered DeFi enabled by Botanix.

We’re at the start of a new era for Bitcoin. One where its liquidity, security, and trustless nature work together to redefine decentralized finance.

And the best part? This is only the beginning.